A Problem Needs Dealing; Software Needs Revealing

By: Unknown

The problem with these projections is that they are based entirely on this "trust fund," which is, in essence, a giant pile of IOUs built up from over half a century of the government skimming the surplus off the top to pay for other social programs. The assumption is that the government will eventually have to make good on these with real money, but that may not be the case.

You see, people assume the government is capable of paying these bills because the government is capable of shouldering much larger deficits without flinching. These deficits, however, are almost invariably not paid with real cash. Rather, it is a system of trading credit in which some foreign or rich private official loans the government, and the government pays it back with a similar trade. Seldom, if ever, does actual money, gold, or debit change hands. It is just credit between the two. Now, with mounting deficits and decreasing surpluses on each side of the fence (compared to GDP), it is doubtful the government can actually afford these IOUs. And before someone points to the Clinton surplus ("the largest in history"), let me point out that this was, first, not actual money, but merely a reduction in the then-$5.7 trillion national debt, and second, that the 2000 surplus only ran $300 billion, which, while numerically a record, was only about 3% of the US GDP. Even so, the last budget surplus before Clinton was in '69, and Clinton's were almost entirely because of the astoundingly robust 90s economy.

Regardless, we are a government of deficits. We may not be able to pay the IOUs. Even if we could, though, it's irrelevant. If a system can be made better, even if it's okay now, our duty is to improve upon it. Smith did say this, which, honestly, surprised me a bit.

While Smith is, perhaps, correct semantically, every dollar is very much your money, as it is the fruit of your efforts. In an optimal Republican country, you would likely be allowed to choose on your tax forms exactly where each dollar would go. That would be a beurocratic nightmare, and would severely damage some social programs that make this country compassionate, because they wouldn't be funded. In this case, though, doing what you wish with your money will not harm the program, due to its pay-as-you-go nature. Since only a certain percentage of the total current tax could be shifted to mutual funds (not stocks, technically), there would still be enough money in the system to pay it out (with deficits, yes, but not overly major ones) until the private system earned profits.

This is actually a compromise situation. I assure you my party believes full privatization would be a better way to go, were it not for the ill-educated people who wouldn't know how to properly invest and the compassion (most) people feel for those poor fools. At any rate, being able to choose one's own mutual fund (out of the three) is a good step in the right direction. This allows not only customization of one's returns, and management of one's risks and rewards, but a sense of ownership is inherent. When a person is allowed to make a decision, no matter how small, they begin to take pride in that decision's outcome. With the sense of ownership over these funds, people are much more likely to increase their productivity, thereby increasing not only the amount of invested funds, but the amount of taxes flowing into the "old" system. I think, with this incentive, the estimates of deficits for running the system and idea that it does not improve the nation are false. I think this is a fine way to boost the economy, honestly.

And the idea that these particular mutual funds are somehow less sure than social security is not precisely correct. While there is a chance of catastrophic failure, it is approximately the same as the chance of failure under the current system. These particular funds have a long history of performing as well or better than the market as a whole. It's not really all that risky, and, since it's optional, and one could (presumably) move their savings about into different funds at will, it will not cause harm unless people are incredibly stupid and jump onto a sinking ship.

Now this sounds reactionary. One shouldn't jump to conspiracy-theories as conclusions. It's illogical to think that the top income-earners would even care about these taxes. As Democrats love to bandy about, these taxes simply don't burden them. At $100 million a year and above, one runs out of things to buy. Similarly, there's no reason for them to want to abolish the old social programs. Republicans, rich and middle-class (as well as the five or six poor people) benefit from these social programs like everyone else.

However, Republicans do, in fact, want to improve these programs, and we want things to be fair. Taxes shouldn't have tiers: one person should not be deemed worthy of special treatment for an arbitrary reason. The percentage nature of taxes takes care of that. I would never support a flat tax. One should be taxed proportionate to their means, but the current system does not do that. The tiers remove the equity from the system by arbitrary measures, and I think that is bad. As the staunch defendants of so many "rights," Democrats ought to support that.

The FDR social programs were all set up within a very short time, and are rife with inefficiencies. From Medicaid's high costs, poor returns, and unimaginable red tape, to social security's poor returns and eventual lack of solvency, these programs need fixing. Everyone should have an equal chance to succeed, and people on government-run programs do not get this advantage. These behemoths are unable to compete with their private counterparts because they don't have to. If we actually brought them some accountability, provided competitive alternative options (like the three mutual funds), and allowed people to move their business to whichever company they deemed most worthy, these beaurocratic nightmares would become viable, useful programs, that effectively helped the poor and downtrodden to get to the self-actualizing state of self-support.

All that said, I did see an interesting proposal in an editorial letter in the Raleigh N&O the other day (I can't remember who sent it, but it wasn't me, so don't credit me). The author suggested a 1% tax on incomes over $100 million a year or so. It would virtually guarantee solvency and, as I said, they wouldn't notice it. It infringes a bit on my belief in income tax equity, but one must make small sacrifices for the common good.

On a lighter note:

In tech news, Picasa 2 is out, and it's fricking awesome (in a good way, not the old way. Technically, the Hindenburg was awesome). Picasa was a photo sorting and album software that was purchased by Google last year, when they integrated Hello with Blogger to allow photo-blogging, but this new version is much better. Besides the integration of the Google search API into the search function (for labels and keywords and captions and such), it's got a very robust image editor, rivaling some professional photo editors. It's got a neat collage function, integration with gmail and, of course, Hello's BloggerBot, and, perhaps best off all, it's entirely free! This is a must-download, for sure.

I'll put up some examples of the collages below.

Picture Pile collage. Pretty cool, really. You can put a picture in the background, as Google's Blog did.

This is the standard style collage. Just pictures aligned along the edges. There are two other varieties, but I can't find any pictures that look good in them.

Posted by Hello

By my hand,

~Michael Akerman

I'm sure you've all read Smith's Social Security post by now (because you all read IVIC religiously, right? Right?). And I'm sure you know, I have to respond to it. Feel free to skip past the block quotes if you've already read it.

I think it was Ronald Reagan who coined the term, "This is a cure for which there is no known disease." The Gipper's description is aptly appropriate to describe the harebrained scheme of the man who, more than any other Republican, slavishly and self-consciously tries to emulate him.

First and foremost, Bush's whole claim for the necessity of his proposed reforms is that Social Security will go belly-up and not be able to pay benefits to younger workers:

[snip]

So, in 2018, the system will collapse, right? Wrong. Because the Boomers have been working all these years, contributing more in payroll taxes than the government is spending on benefits to current retirees. Because there are so many Boomers who have been working for so many years, and the government raised payroll taxes substantially back in the 1980s, Social Security has built up a little trust fund. Ok, a really, really big trust fund. So, in or around 2018, the government will have to start spending the money in that trust fund to cover paying out benefits to retires. But even then, as it currently stands, Social Security will be able to continue to pay out full benefits until at least 2042, according to the Social Security Trustees, or 2052 according to the nonpartisan Congressional Budget Office.

The problem with these projections is that they are based entirely on this "trust fund," which is, in essence, a giant pile of IOUs built up from over half a century of the government skimming the surplus off the top to pay for other social programs. The assumption is that the government will eventually have to make good on these with real money, but that may not be the case.

You see, people assume the government is capable of paying these bills because the government is capable of shouldering much larger deficits without flinching. These deficits, however, are almost invariably not paid with real cash. Rather, it is a system of trading credit in which some foreign or rich private official loans the government, and the government pays it back with a similar trade. Seldom, if ever, does actual money, gold, or debit change hands. It is just credit between the two. Now, with mounting deficits and decreasing surpluses on each side of the fence (compared to GDP), it is doubtful the government can actually afford these IOUs. And before someone points to the Clinton surplus ("the largest in history"), let me point out that this was, first, not actual money, but merely a reduction in the then-$5.7 trillion national debt, and second, that the 2000 surplus only ran $300 billion, which, while numerically a record, was only about 3% of the US GDP. Even so, the last budget surplus before Clinton was in '69, and Clinton's were almost entirely because of the astoundingly robust 90s economy.

Regardless, we are a government of deficits. We may not be able to pay the IOUs. Even if we could, though, it's irrelevant. If a system can be made better, even if it's okay now, our duty is to improve upon it. Smith did say this, which, honestly, surprised me a bit.

Just because there is no pressing threat to Social Security doesn't rule out any proposed reforms, it only eliminates their urgency. So, let's take a look at the arguments of the privatizers (let's call them "Privateers") and see if they hold up to the cold, hard light of reason.

The most-touted argument for privitization is that the money you pay in payroll taxes into Social Security is "your money, so you should be able to invest it as you choose." This also the easiest argument to debunk. The payroll taxes those of us who work pay to Social Security aren't "our money". The taxes we pay go to support those who are already retired. That generation worked and paid payroll taxes to support the generation before it. And so on.

While Smith is, perhaps, correct semantically, every dollar is very much your money, as it is the fruit of your efforts. In an optimal Republican country, you would likely be allowed to choose on your tax forms exactly where each dollar would go. That would be a beurocratic nightmare, and would severely damage some social programs that make this country compassionate, because they wouldn't be funded. In this case, though, doing what you wish with your money will not harm the program, due to its pay-as-you-go nature. Since only a certain percentage of the total current tax could be shifted to mutual funds (not stocks, technically), there would still be enough money in the system to pay it out (with deficits, yes, but not overly major ones) until the private system earned profits.

What about the argument that over the past 70 years, the stock market has delivered a higher rate of return for investment than Social Security? As far as I know, that one's actually true. You very well might get more bang for your buck from the stock market. Then again, you might not. Social Security is a sure thing. The stock market is America's favorite game of chance.

At the President's Social Security "Summit" this week, where the President conversed with "ordinary Americans" who agreed to parrot the White House's stance on this issue, Bob McFadden, a man from Medford, New Jersey, said, "I believe, personally, that if it's in a personal account, I can invest my money better than the government." This a common argument among the "privateers". The only problem is that you won't be doing the investing at all. The government will. At the same summit, Bush said, "You won't be allowed to just take that money and dump it somewhere."

This is actually a compromise situation. I assure you my party believes full privatization would be a better way to go, were it not for the ill-educated people who wouldn't know how to properly invest and the compassion (most) people feel for those poor fools. At any rate, being able to choose one's own mutual fund (out of the three) is a good step in the right direction. This allows not only customization of one's returns, and management of one's risks and rewards, but a sense of ownership is inherent. When a person is allowed to make a decision, no matter how small, they begin to take pride in that decision's outcome. With the sense of ownership over these funds, people are much more likely to increase their productivity, thereby increasing not only the amount of invested funds, but the amount of taxes flowing into the "old" system. I think, with this incentive, the estimates of deficits for running the system and idea that it does not improve the nation are false. I think this is a fine way to boost the economy, honestly.

And the idea that these particular mutual funds are somehow less sure than social security is not precisely correct. While there is a chance of catastrophic failure, it is approximately the same as the chance of failure under the current system. These particular funds have a long history of performing as well or better than the market as a whole. It's not really all that risky, and, since it's optional, and one could (presumably) move their savings about into different funds at will, it will not cause harm unless people are incredibly stupid and jump onto a sinking ship.

Which raises the question of why the President is so adamant about this issue. The President didn't simply misspeak when he said that Social Security will be "flat broke" by the time today's 20-year olds reach retirement age. Neither the government agency responsible for administering Social Security nor the CBA backs up what Bush is saying. Unlike Iraq's WMD, there is not a legitimate difference of opinion among the government analysts on this issue. If the president is so interested in creating an "ownership society", why won't he own up to the facts? He is deceiving the American people in the most cynical way. But to what end?

Again, Krugman has the scoop: "Last week someone leaked a memo written by Peter Wehner, an aide to Karl Rove, about how to sell Social Security privatization. The public, says Mr. Wehner, must be convinced that 'the current system is heading for an iceberg.' It's the standard Bush administration tactic: invent a fake crisis to bully people into doing what you want. 'For the first time in six decades,' the memo says, 'the Social Security battle is one we can win.' "

What battle could they be talking about? The battle to abolish Social Security, of course, the long-time dream of the ultraconservatives. And not just Social Security. These are reactionaries who want to abolish all of the government social welfare programs established in the Twentieth century, all of the programs of the Great Society and the New Deal, as well as all of the reforms of the Progressives. From "tort reform" to regulations on businesses to ensure the safety of our food supply, workplaces, and environment, government regulations are being abolished left and right. These Reactionary Republicans even dream of abolishing the income tax (which weighs most heavily on those who can afford to be taxed most heavily) in favor of a flat tax or a national sales tax (which would weigh most heavily on those Americans who can least afford the burden).

Now this sounds reactionary. One shouldn't jump to conspiracy-theories as conclusions. It's illogical to think that the top income-earners would even care about these taxes. As Democrats love to bandy about, these taxes simply don't burden them. At $100 million a year and above, one runs out of things to buy. Similarly, there's no reason for them to want to abolish the old social programs. Republicans, rich and middle-class (as well as the five or six poor people) benefit from these social programs like everyone else.

However, Republicans do, in fact, want to improve these programs, and we want things to be fair. Taxes shouldn't have tiers: one person should not be deemed worthy of special treatment for an arbitrary reason. The percentage nature of taxes takes care of that. I would never support a flat tax. One should be taxed proportionate to their means, but the current system does not do that. The tiers remove the equity from the system by arbitrary measures, and I think that is bad. As the staunch defendants of so many "rights," Democrats ought to support that.

The FDR social programs were all set up within a very short time, and are rife with inefficiencies. From Medicaid's high costs, poor returns, and unimaginable red tape, to social security's poor returns and eventual lack of solvency, these programs need fixing. Everyone should have an equal chance to succeed, and people on government-run programs do not get this advantage. These behemoths are unable to compete with their private counterparts because they don't have to. If we actually brought them some accountability, provided competitive alternative options (like the three mutual funds), and allowed people to move their business to whichever company they deemed most worthy, these beaurocratic nightmares would become viable, useful programs, that effectively helped the poor and downtrodden to get to the self-actualizing state of self-support.

All that said, I did see an interesting proposal in an editorial letter in the Raleigh N&O the other day (I can't remember who sent it, but it wasn't me, so don't credit me). The author suggested a 1% tax on incomes over $100 million a year or so. It would virtually guarantee solvency and, as I said, they wouldn't notice it. It infringes a bit on my belief in income tax equity, but one must make small sacrifices for the common good.

On a lighter note:

In tech news, Picasa 2 is out, and it's fricking awesome (in a good way, not the old way. Technically, the Hindenburg was awesome). Picasa was a photo sorting and album software that was purchased by Google last year, when they integrated Hello with Blogger to allow photo-blogging, but this new version is much better. Besides the integration of the Google search API into the search function (for labels and keywords and captions and such), it's got a very robust image editor, rivaling some professional photo editors. It's got a neat collage function, integration with gmail and, of course, Hello's BloggerBot, and, perhaps best off all, it's entirely free! This is a must-download, for sure.

I'll put up some examples of the collages below.

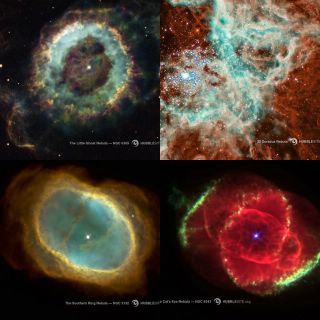

Picture Pile collage. Pretty cool, really. You can put a picture in the background, as Google's Blog did.

This is the standard style collage. Just pictures aligned along the edges. There are two other varieties, but I can't find any pictures that look good in them.

Posted by Hello

By my hand,

~Michael Akerman

0 comments:

Post a Comment